Anúncios

ADS

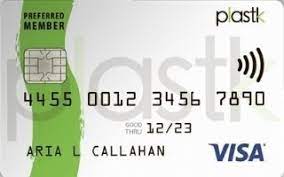

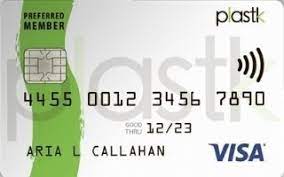

Embarking on a journey to financial stability and freedom, especially in the dynamic financial landscape of Canada, requires the right tools. One such tool that stands out is the Plastk Secured Visa Credit Card.

Rates & Fees

PLASTK CREDIT CARD

Plastk Secured Visa Credit Card

Easy to qualify

Premium Rewards

A secured credit card is just like a “regular” credit card but it is secured by a deposit which is used as collateral.

You will be redirected to another website

What Are the Requirements to Apply for the Plastk Secured Visa Credit Card?

Before diving into the application process, it’s crucial to understand the eligibility criteria for the Plastk Secured Visa Credit Card. The primary requirements include:

- Age and Residency: Applicants must be of legal age, which varies by province or territory in Canada. Additionally, a permanent residency in Canada is required to ensure that the applicant falls under Canadian financial jurisdiction.

- Employment and Income: Stable employment is a key factor. While there may not be a strict minimum income requirement, having a regular source of income demonstrates the ability to manage credit effectively.

- Credit History: This card is particularly tailored for those with limited or challenged credit histories. Hence, a less stringent check on past credit performance is a hallmark of this card’s accessibility.

- Security Deposit: A key aspect of this secured card is the security deposit, which directly influences the credit limit. This deposit mitigates risk for the issuer and makes the card accessible even to those with less than perfect credit.

What Documents Are Needed?

When applying for the Plastk Secured Visa Credit Card, having the right documentation ready streamlines the process. The necessary documents generally include:

- Identification Proof: A valid government-issued ID, such as a driver’s license or passport, is essential to establish identity.

- Proof of Residence: Utility bills or a lease agreement can serve as proof of your residence in Canada.

- Income Verification: Recent pay stubs or tax returns may be required to verify stable income.

- Bank Information: Bank statements or account details may be needed for the security deposit and to set up direct billing.

In conclusion, the Plastk Secured Visa Credit Card is more than just a credit-building tool; it’s a pathway to greater financial autonomy and security. With reasonable requirements and a straightforward application process, it’s a viable option for many Canadians. Whether you’re starting your credit journey, rebuilding your financial standing, or simply seeking a reliable and rewarding credit card, the Plastk Secured Visa might just be the key to unlocking your financial potential. Remember, responsible use of this card can pave the way for a brighter financial future.

Navigating the Plastk Secured Visa Credit Card: Maximizing Its Potential

The Plastk Secured Visa Credit Card is more than just a financial tool; it’s a gateway to numerous possibilities. Ideal for Canadians looking to build or rebuild their credit, this card offers the unique combination of security and flexibility. But what truly sets it apart are the diverse ways it can be utilized to enhance your financial life. Let’s delve into some of the most common and beneficial uses of this versatile credit card.

Building Credit History

One of the cardinal uses of the Plastk Secured Visa Credit Card is to build or repair credit history. With its secured nature, it provides a low-risk way for lenders to extend credit. Regular usage and timely payments contribute positively to your credit score, gradually paving the path to more favorable credit terms in the future.

Everyday Purchases

The Plastk card excels in everyday convenience. Whether it’s groceries, gas, or online shopping, using this secured card for daily transactions is effortless. Plus, the rewards program turns these routine purchases into opportunities to earn points, adding a layer of value to your everyday spending.

Travel Companion

For those who love to explore, the Plastk Secured Visa Credit Card is a reliable travel partner. Its worldwide acceptance means you can use it for hotels, flights, and other travel-related expenses. The added security features of a Visa card bring peace of mind when you’re away from home.

Emergency Fund

In times of unexpected expenses, the Plastk card can be a financial lifesaver. The credit limit set by your deposit can act as a buffer in emergencies, offering a ready source of funds when you need it most.

Our Advice for Prospective Plastk Secured Visa Credit Card Applicants

If you’re considering the Plastk Secured Visa Credit Card, here’s our advice: think of it as a stepping stone in your financial journey. Use it wisely to build your credit, but be mindful of the pitfalls of overspending. Make sure to pay your balance in full each month to avoid accruing interest and to positively impact your credit score.

Remember, the security deposit is your money and determines your credit limit. Choose an amount that aligns with your financial capacity and goals. Most importantly, view this card as an opportunity to establish healthy financial habits, such as budgeting and regular credit monitoring.

Pondering Advantages and Disadvantages – Is It Worth It?

When evaluating the Plastk Secured Visa Credit Card, its advantages are quite compelling. The ability to build or repair credit is its most significant benefit. Since it’s a secured card, it’s accessible even to those with less-than-ideal credit histories. The opportunity to earn rewards on everyday purchases adds an element of incentive that’s not often found in secured cards. Furthermore, the global acceptance of Visa ensures convenience and security for both domestic and international use.

On the flip side, the requirement of a security deposit might be a hurdle for some, and the interest rates could be higher compared to unsecured cards. However, these aspects are common among most secured cards and are part of the trade-off for the easier approval and credit-building opportunity they provide.

Overall, the Plastk Secured Visa Credit Card is indeed worth considering, especially for those who are new to credit or working to improve their credit score. It’s an excellent stepping stone towards financial health, offering a controlled environment to practice responsible credit usage. It’s particularly beneficial for those who might not qualify for traditional credit cards but still want to enjoy the perks and conveniences of a Visa card.

Apply Now for the Plastk Secured Visa Credit Card on the Official Website!

Ready to take control of your financial future? The Plastk Secured Visa Credit Card is just a few clicks away. Embrace the opportunity to build a robust credit history while enjoying the perks of a rewards program. This card is more than just a credit-building tool; it’s a path to greater financial freedom and responsibility.

Don’t miss out on this chance to reshape your financial landscape. Click the button below to apply for the Plastk Secured Visa Credit Card on the official website. Take this step towards securing a brighter financial future for yourself, one where responsible credit use opens doors to new possibilities. Apply now and start your journey to credit success!